Procore’s Canadian Construction Trends to Watch in 2023

January 13, 2023

By Jas Saraw, VP, Canada, Procore

Looking at Canadian contruction trends in 2023, I expect a year of challenge and change as the Canadian construction industry grapples with ongoing problems such as the labour shortage while continuing to move toward integrated project delivery to achieve greater efficiency. At Procore, we are watching adoption of on-site technologies such as drones and augmented reality with interest, while we also expect further developments in project tools that improve the connection from the field to the back office, and offer predictive insights in order to further drive project efficiency.

Here are the construction trends we are tracking at Procore:

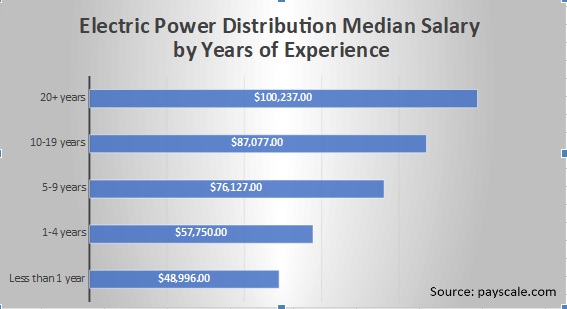

The Canadian labour shortage will continue challenging the industry. Not enough people are joining construction, which will mean a continued labour shortage in 2023. According to the Canadian Construction Association, 22 per cent of the Canadian construction workforce will be retiring by 2028. The loss of that experience and knowledge is a significant concern.

* In addition to attracting more young people to the industry, technology will continue to help construction organizations do more with the workers they have. Streamlining processes with technology will reduce the time spent on non-productive tasks out in the field, and will enable employees to focus on more pressing work. I discussed this at Groundbreak:

* Labour technology is going to have a big impact in 2023; in particular, scheduling tools that help get the right people in the right place at the right time.

* Provinces and organizations will continue to highlight the industry to potential workers. For example, Ontario has made an effort to introduce students to construction during elementary school. It also made it easier to transfer credentials for workers entering the province, and recently expanded its program allowing students to take apprenticeships while in high school.

AR and VR will demonstrate their potential. Virtual reality provides opportunities for training by simulating actions workers need to do. This could have implications for the labour shortage. Once in the field, the focus will be on augmented reality (in consideration of the danger of immersing yourself in a virtual world on a jobsite). AR can mitigate the financial risk of the design and concept stages, and its use could grow greatly in 2023.

Field processes will evolve with financials at the forefront. In construction, change happens in the field. But construction software can often only take the back-office into account. Financial tools will become more field-friendly in 2023, connecting the knowledge in the field to the office. For example, the field is first to know when a subcontractor encounters something that will delay the schedule or be a cost overrun. Financial tools that share information with stakeholders in real-time will gain ground.

Drone usage will rise. Canada leads other regions with use of drones, according to Dodge Construction Network’s report, 2022 Top Business Issues for Specialty Contractors Report. Thirty per cent of large or very large companies surveyed have already implemented site cameras, drones and onsite sensors, compared to U.S. companies with an average of 19 per cent. In 2023, drone usage will continue to grow to identify hazards and improve site safety.

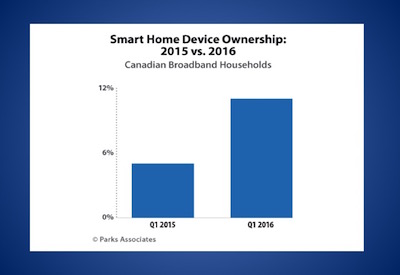

There will be a shift to integrated project delivery. As labour, supply chain and financial constraints put pressure on the industry, there will be accelerated adoption of integrated project delivery to improve efficiency, streamline collaboration between stakeholders and minimize waste. Clean energy and sustainability will continue to be a focus. Sustainable construction projects are becoming more and more common in the news. While energy and climate issues are a priority globally and affect all industries, the Canadian construction sector in particular is very mindful of sustainability. We expect contractors and construction organizations will continue to work closely with government on these issues, as research and investments in these areas grow. ESG (Environmental, Social, Governance) will guide industry leaders in 2023, as they seek to create a bold new future for construction focused on reducing construction waste, mitigating rework, and enabling safer job sites with effective quality control.

Skillsets among workers will continue to diversify. As organizations are learning to do more with less, we’re seeing shifts in what used to be very distinguished roles. Owners have more in-house general contractors; general contractors are engaging in more self-perform work. In 2023, we expect to see this continue, with more organizations diversifying what they’re good at, in order to find efficiency, quality and productivity gains.

Predictive analytics will bring more insights. With more contractors moving project information from paper to the cloud, it will be increasingly possible to draw insights from historical data to inform decisions about budgets, scheduling and other aspects of construction. AI (Artificial Intelligence) and ML (Machine Learning), will take the complex data and voluminous data that is collected on jobsites and start to make sense of the data in order to drive predictive insights that will allow all project stakeholders to make more effective decisions earlier in the design and build process and ultimately shield themselves from downstream risk as the project schedule progresses.

You can follow my thinking on these and other matters in Canadian construction in my monthly newsletter, Breaking Ground. I welcome conversation and insights from the community.

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition – A Road Map: Section 10 – Grounding and Bonding](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2.png)