Challenges, Opportunity, and Labour Demand in the Construction Industry

January 27, 2023

By Blake Marchand

There is some uncertainty in the overall market right now, relating to inflation, interest rates, even global events like the war in Ukraine have an impact. These factors will have an impact on the construction industry, which may have an impact on broader opportunities for electrical contractors. Although, anecdotally there’s a cautious optimism with respect to the opportunity 2023 will bring for electrical contractors.

Electrical Industry News Week recently spoke to Robert Bronk from the Ontario Construction Secretariat to gain some insight into his perspective on the construction industry in general. As Bronk explains below, the construction industry has the ability to prop up the economy in challenging economic times.

Beyond the economy, a key challenge for the construction industry will be demand for labour, and that includes the electrical trade.

Bronk’s primary focus with OCS is labour relations and market research, “our main mandate is research here and to facilitate labour relations, as well as to help formulate public policy and support the unionized ICI (industrial, commercial, institutional) construction sector.”

A member of the OCS staff, Katherine Jacobs, is on the Built Force Canada committee, which looks at labour demand predictions and forecasting across the country. OCS plays a role in determining what regions and what trades are in demand of workers.

“Right now, the six-year forecast is there’s going to be 56,000 retirements,” Bronk noted, with respect to the construction industry in Ontario. “There’s going to be a need to replace them,” he said. On top of that, there is an increase in work, with the number of projects that have already been announced by governments and the private sector.

The prediction is that 15,000 people will be needed above that 56,000.

To provide some perspective on the current level of work in ICI construction, Bronk referred to the ‘Crane Index’ which provides a rough estimate of the number of tower cranes active across North America.

“The city with the largest number of tower cranes in the States is Los Angles with 51, second place is Seattle with 37. Toronto has 252 tower cranes. The GTA has 40% of the tower crane inventory in North America.”

Bronk reiterated that it’s a rough estimate, “but it shows you the magnitude,” he said, adding that there is a lot of construction happening across the province on top of that, as well.

As part of OCS’s contractor survey, they found that labour shortages and quality, as well as supply chain were among the more significant challenges. Bronk noted that immigration plays a role in population growth and the labour market. However, the pandemic really slowed down immigration which has had an impact on the labour market.

“There hasn’t been that steady stream of new Canadians, then you have all these other external factors like the war in Ukraine,” he said, which adds a level of uncertainty to the banking industry as well as governments in terms of how it will impact the economy.

Interest rates are another one of those external factors impacting infrastructure investments, the economy, and the demand for labour. Early on in the pandemic, rates were low in an effort to boost the economy and that led to an increase in investment. A few years into the pandemic and those rates have risen considerably as the central bank aims to address surging inflation. By some reports, 2023 could mean a recession in Canada. Construction projects are often scheduled years in advance, so we could still be seeing the benefit from investments spurred by lower rates, which, coupled with the demand for housing in many different jurisdictions, the construction industry may be able to withstand or even prop up a slowing economy.

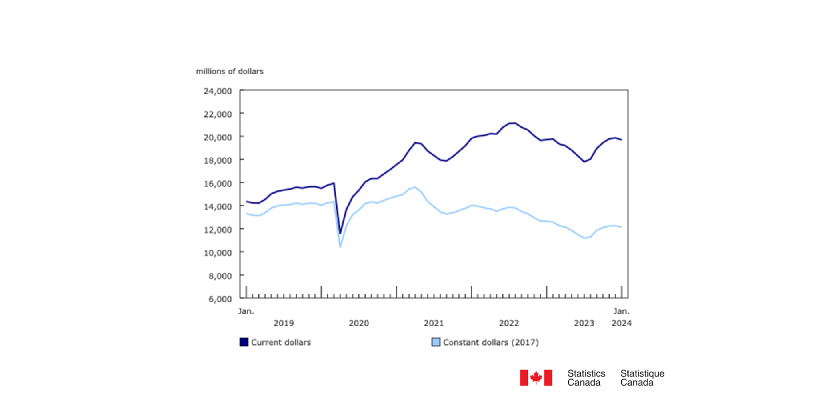

“Investment across Canada increased dramatically in 2021 as Canada’s economy recovered from COVID-19. Total year-over-year construction investment increased by approximately 11% in 2021 and was 10% higher than levels recorded in 2019. Non-residential construction increases were less pronounced, despite a significant rise in public-sector investments,” notes Build Force Canada’s National Construction and Maintenance Looking Forward report.

The residential sector saw a higher increase in investment, rising 14% compared to 2020 and 17% compared to 2019.

“Construction investment is essentially sustained into 2023 and then declines gradually over the six-year forecast period. Total investment is expected to be approximately 1% lower by 2027 than levels posted in 2021.”

Optimism was an interesting take away from OCS’s contractor survey, for Bronk. It was a guarded optimism, he noted, but said that the construction industry responded well to the conditions brought on by the pandemic. Given Build Force Canada’s projections, that guarded optimism seems to be warranted.

Electrical Industry News Week’s 2022 survey of Canadian electrical contractors showed a bit of optimism for 2023, 45% of those surveyed were ‘somewhat optimistic’ and 31% were ‘optimistic’, 12% ‘very optimistic’, and only 10% were in the negative. When it came to plans for growth of businesses or services it was a 60/40 split in favour of growth.

So, while overall market projections appear to be fairly grim with respect to the economy, there is a sense of positivity within the construction industry for 2023, despite looming labour shortages.

Large construction projects create social benefits and reverberating economic impacts, Bronk noted, “Investing in these projects, you’re obviously paying construction workers, but then the contractors are buying the equipment and components,” which benefits the distributors, the manufactures, and on down the supply chain. And then looking outside the trade, steady employment for the workers leads to more buying power personally, which puts more money into the broader economy.

The current situation with inflation complicates things, however. Essentially, The Bank of Canada raises interest rates in an effort to slow down the economy and in turn lower inflation. Essentially, if things cost more, people will spend less money, demand will fade, and inflation will trend toward the ideal benchmark of 2%.

The multiplier according to Stats Canada, Bronk said, is around 2.5, “Every dollar you invest in a major construction project gets multiplied by 2.5 times, that’s the impact on the economy and it’s really helped Ontario and Canada through these past two years.”

Build Force Canada research shows that commercial building construction may continue to feel the impacts of labour market pressures that developed in 2021 for Ontario, “Across the forecast period, the pace of residential activity is expected to moderate, but a growing inventory of major infrastructure projects and a projected recovery in commercial building construction contributes to ongoing labour market pressures to 2023,” explains the introduction to their Construction and Maintenance Looking Forward, 2022-2027 report.

“Between 2022 and 2027, the (Ontario) industry will need to add approximately 15,500 additional workers to keep pace with construction demands. The retirement of more than 56,300 workers – 13% of the current labour force – will increase the recruitment requirements for the industry to approximately 71,800 workers over the six-year forecast period,” says the Build Force Report.

“Recent heightened promotional and recruitment activities are bearing fruit. Over the forecast period, the non-residential sector is expected to draw in more new-entrant workers under the age of 30 than those lost from the industry to retirements.”

Build Force Canada’s projections show that the industry is expected to add 53,000 workers, which would lead to approximately 18,000 deficit for construction workers compared to projected demand.

The construction forecast for Canada is that investment will remain high for 2023 before declining gradually over the next four years after that.

Alberta will need to recruit 27,000 workers by 2027 to keep pace with demand with 22,500 projected retirements, B.C. is in a similar position with 27,600 workers needed to keep up with demand with 25,000 projected retirements.

Nationally, the construction industry will need to recruit just under 143,000 workers under the age of 30, Build Force Canada projects.

You can find Build Force Canada’s projections by province HERE.

The projection for electricians is that there will be 3,100 deficit over the next six years.

Another compounding factor for filling the labour gaps is that there is labour demand across trades and across industries, “It’s competitive out there,” said Bronk.

“To the credit of Minister McNaughton, the minister of labour, they’ve done a great job in terms of media outreach trying to promote the trade. He’s been handcuffed because of the pandemic, but they’ve been doing a great job to remove the stigma.”

Federal and provincial governments have been making a strong push to promote the trades, with investments as well as public appearances. The federal government is making a push to boost apprenticeship across the country by giving small and medium sized contractors incentives to hire new apprentices. Several provinces have also revamped and begun revamping their apprenticeship certification systems to help streamline apprenticeship.

“A certain percentage of the population doesn’t understand how complex construction has become. The equipment people use, the tools, you’re an apprentice for 4-5 years, it’s the same as going to university, before you can qualify to become a journey person,” noted Bronk with respect to the ‘stigmas’ that persist around the trades. Although, a lot of work is being done to paint a more accurate picture of what a career in the skilled trades means.

Bronk noted there are also different career paths you can take once you get your journeyperson ticket.

“After a while you can get pricing and estimating courses etc. and start your own business to become a trades contractor. There’s a career path out there that people don’t really recognize.”

“It’s not all manual labour and using a hammer, it’s very sophisticated. Some of the mechanical trades now are using augmented reality, its smart buildings, the internet of things; it’s gotten to be very high tech. For people looking for a career, who are engaged with technology, I’m not sure they understand how much construction has embraced technology. If they want to be creative and innovative, there’s a lot of opportunity to do that.”

The greening of the economy adds another layer to the demand for electrical as well as different construction trades that is technologically advanced as well as being critical to the future.

When it comes to integrating electric vehicles and charging stations into existing infrastructure, retrofitting existing buildings to make them smart and efficient, as well as the new build projects, “that’s all state of the art,” Bronk said.

There are also career paths for trades people that take you off the tools or out of the field as estimator, salesperson, teacher, union representative, or working with a contractor association, just to name a couple examples of where you can take your career as a tradesperson.

“There’s a lot of career paths,” he said, and when it comes to the electrical trade, Bronk said, “the level of training that trade really is a high bar. When you think about it, they are dealing with the most dangerous stuff, but they have the safest track record.”

The training that electricians go through makes them highly regarded, Bronk noted.

Construction Training and Apprenticeship Ontario is a recent initiative from OCS and Canada Building Trades Unions to help job seekers find opportunities in the construction trades.

There are a lot of trades outside of the obvious ones like electrician, carpenter, plumber, etc. like glazier, boiler maker, millwright. “If you’re not aware of some of these different options, how are you going to know if it appeals to you or if its something you would want to consider?”

They wanted to take a one stop website that explains what you can expect from different trades, the wages, the opportunity, where the training centers are; similar to what you have for universities.

If you live in Ottawa and you want to be an electrician, plumber, glazier, millwright etc. you can go to CTAOntario.com and find out where the training centers are and what the pre-requisites are for each trade, for example.

The initiative is to promote the trades and make it easier for people to connect and make better decisions, “it’s trying to fill that information void.”

“We’re supporting what the minister is doing in terms of promoting the trades. We’re coming out with some research to try and reemphasize the social benefits of what construction does to society in terms of bringing people into the middle class and how we can use our tax dollars wisely with social procurement policies to target communities and get more of those residents into construction, because it does have an impact on a local community. When you bring them into the middle class, it’s the same as a university degree.”

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition – A Road Map: Section 10 – Grounding and Bonding](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2.png)