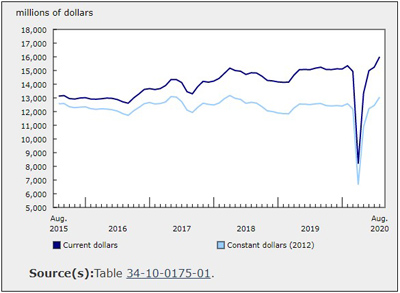

Gross Domestic Product by Industry, June 2022

September 8, 2022

Real gross domestic product (GDP) edged up 0.1% in June, following an essentially unchanged May.

Both services-producing (+0.2%) and goods-producing (+0.1%) industries were up, as 14 of 20 industrial sectors expanded in June.

Advance information indicates that real GDP edged down 0.1% in July. Output was down in the manufacturing, wholesale, retail trade and utilities sectors. Declines were partly offset by increases in the mining, quarrying, oil and gas sector and the agriculture, forestry, fishing and hunting sector. Owing to its preliminary nature, this estimate will be updated on September 29 with the release of the official GDP data for July.

Client-facing industries up, benefitting from continued easing of public health and border restrictions

June 20, the Government of Canada suspended vaccine mandates for passengers travelling on a plane or train within the country and, on June 11, paused random COVID-19 testing for fully vaccinated international travellers arriving at Canadian airports. At the same time, the Government of Ontario dropped its masking requirements in higher-risk indoor settings on June 11.

Accommodation and food services continue to grow

As the number of overseas and US visitors entering Canada grew in June, the accommodation and food services sector rose 0.8%, as both of its subsectors were up.

The accommodation services subsector grew for the fourth time in five months, up 1.8% in June.

Food services and drinking places increased for the fifth consecutive month, up 0.4% in June. The pace of growth in the subsector decelerated following a strong rebound in activity post Omicron wave.

Transportation and warehousing sector keeps growing

The transportation and warehousing sector edged up 0.1% in June, after four months of strong growth. Widespread growth across subsectors was largely offset by a 3.7% decline in the rail transportation subsector in June, when volume of goods moved by rail decreased.

Air transportation grew 5.6% in June, up for a fifth consecutive month, more than doubling since January 2022. The gain in June was largely driven by higher movement of passengers carried as the number of passengers carried by major Canadian airlines increased sevenfold from June 2021. However, the industry was about 40% below its pre-pandemic level.

Urban transit systems rose 2.3% in June, up for a fifth consecutive month, as many Canadians continued to transition back to in-person or hybrid work and decreased their time at home.

Arts, entertainment and recreation sector rises

Arts, entertainment and recreation increased 1.8% in June, marking a fifth consecutive monthly growth. The amusement, gambling and recreation subsector (+2.4%) contributed the most to the increase.

Performing arts, spectator sports and related industries, and heritage institutions continued to grow, rising 1.1% in June. The Edmonton Oilers’ appearance in the National Hockey League (NHL) Western Conference Finals played in June and helped lift the subsector and many sports fans’ spirits across the country.

Industries sensitive to interest rate movements affected by Bank of Canada’s announcement

On June 1, the Bank of Canada announced an increase to its overnight rate by 50 basis points, continuing its monetary tightening policy aimed at quelling inflationary pressure in the economy. The third increase of the year further affected industries sensitive to interest rates movements.

Finance and insurance sector continues to decrease

The finance and insurance sector was down 0.6% in June, on broad-based decreases across subsectors, following no growth in May and a 0.4% contraction in April.

A decline in the Standard and Poor’s/Toronto Stock Exchange Composite Index and lower than usual trading volume on the Toronto Stock Exchange contributed to a decline in the financial investment services (-1.6%) and insurance carriers and related activities (-0.4%) as equity mutual funds and asset values fell in June.

A decline in chequing and non-chequing deposits in June further contributed to a 0.4% decrease in depository credit intermediation and monetary authorities. An increase in household mortgage debt offset some of the decline.

Real estate down, home resale activity slows following rate hikes

The real estate and rental and leasing sector edged down 0.1% in June, marking the fourth consecutive monthly decline.

Activity at the offices of real estate agents and brokers dropped 5.3% in June, down for the fourth consecutive month, as the rising cost of borrowing further dampened home resale activity across the country. The declines were largely concentrated in Ontario, British Columbia and Alberta. The level of activity in this industry is now approximately 8% below February 2020’s pre-pandemic level.

Legal services, which derive much of their activity from real estate transactions, declined 2.8% in June.

Construction sector activity continues to fall

The construction sector decreased 0.4% in June, down for the third month in a row, as almost all subsectors decreased, with residential and non-residential building construction contributing the most to the decline.

Residential building construction (-0.5%) was down for the third month in a row, in large part driven by a contraction in the construction of new single detached homes as well as by fewer home alterations and improvements. The level of activity in this industry is still around 8% above the February 2020 pre-pandemic level.

Non-residential building construction (-1.0%) contracted for a second month in a row.

Repair construction (-0.4%) declined for a third month in a row, as both the residential and non-residential repair activities contracted.

Engineering and other construction activities edged up 0.1% in June.

Public sector increases

The public sector (educational services, health care and social assistance, and public administration combined) expanded 0.4% in June, as all sectors were up.

Educational services (+0.7%) contributed the most to the growth in June, as all industries were up, led by elementary and secondary schools and universities.

Agriculture grows, led by crop production

The agriculture, forestry, fishing and hunting sector rose 1.5% in June, led by an increase in crop production. Crop production (except cannabis) rose 3.8%. Farmers’ seeding and better weather continued to provide a positive outlook for the annual harvest, aided in-part by above-average precipitation in Manitoba and Saskatchewan.

Second quarter of 2022

Real GDP expanded 1.0% in the second quarter of 2022, up for a fourth consecutive quarter.

Services-producing industries increased 1.0% and were by far the largest contributors to growth. After showing significant declines or limited growth in the first quarter of 2022 due to the COVID-19 Omicron variant, many services-producing industries, particularly client-facing ones, rebounded in the second quarter. Overall, goods-producing industries also rose 1.0% in the second quarter, marking its third consecutive quarterly increase.

Client-facing industries among the largest drivers of growth in the second quarter of 2022

The removal of COVID-19-related restrictions at restaurants, casinos and spectator sports across several provinces in February and March 2022 contributed to increased spending on client-facing services in the second quarter. This contributed to major gains in the accommodation and food services sector (+14.3%), particularly in food services and drinking places (+13.3%), which more than offset the declines recorded in the previous two quarters. Similarly, arts, entertainment and recreation (+19.8%) also rebounded and recouped the loss recorded in the first quarter of the year. The Toronto Raptors qualified for the National Basketball Association playoffs this year, and both the Edmonton Oilers and Calgary Flames advanced to the second round of the NHL playoffs, with the former making it to the Western conference finals, contributing heavily to the sector’s rebound. However, in the second quarter of 2022, all subsectors of arts, entertainment and recreation remained below their pre-pandemic levels.

Air transportation expanded (+63.0%) for the third time in four quarters, supported by an easing of travel restrictions, including the removal of the requirement for fully vaccinated travellers to provide a negative pre-entry COVID-19 test result to enter Canada by air, land or water as of April 1, and the pausing of all COVID-19 testing at all airports on June 11. Urban transit systems expanded 26% in the quarter, as many public transit users returned to in-person work, while others may have opted for public transit in the face of rising fuel prices. Despite the increase in fuel prices, activity at gasoline stations was also up strongly (+7.9%) indicative of overall greater movement of Canadians.

Real estate and rental and leasing (-0.8%) as well as finance and insurance (-0.3%) both recorded their first declines since the second quarter of 2021. Real estate activity contracted as interest rate hikes during the quarter pushed many would-be home buyers out of the market. The contraction in the finance and insurance sector was largely due to declines in equity asset values, as higher-than-expected inflation numbers stoked investors’ worries about the economy. Declines in deposits, mainly in the form of non-chequing deposits, also contributed to the decline in the sector.

Wholesale trade was a large constraint on growth in the second quarter, down 2.0%. Wholesalers of building materials and supplies were among the largest contributors to the decline, partly due to slowing new home construction and renovation activity.