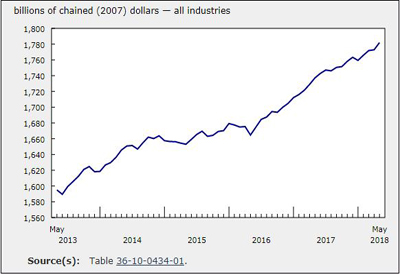

Gross Domestic Product by Industry, September 2022

December 2, 2022

Real gross domestic product (GDP) edged up 0.1% in September. Growth was led by goods-producing industries (+0.3%), while services-producing industries were essentially unchanged.

Advance information indicates that real GDP was essentially unchanged in October. Increases in the public, transportation and warehousing, construction and wholesale trade sectors were offset by decreases in the manufacturing and mining, quarrying and oil and gas extraction sectors. Due to its preliminary nature, this estimate will be updated on December 23 with the release of the official GDP data for October.

Goods-producing industries expand as crude bitumen production level reaches a record high, while manufacturing activity continues to weaken

A significant gain in crude bitumen production in Alberta and the continued momentum in agricultural production largely contributed to the growth in goods-producing industries. Decreased manufacturing activity partially offset these increases.

Crude bitumen fuels mining, quarrying and oil and gas extraction

The mining, quarrying and oil and gas extraction sector rose 1.2% in September, the seventh increase in the last eight months, with growth in two of the three subsectors.

Oil and gas extraction rose 1.8%, led by a surge in oil sands extraction and attributable to a record high level of crude bitumen production (which exceeded the previous records reached in July and August).

Oil and gas extraction (except oil sands) was down 1.5%, driven by a decline in crude petroleum extraction and in part due to maintenance activity at an offshore crude production facility.

Mining and quarrying (except oil and gas) contracted 1.3% in September, mainly due to a decrease in non-metallic mineral mining and quarrying (-3.4%). Significant decreases in shipments of potash destined to Brazil and the United States were observed in September. Despite this monthly decline, the value of potash exports has more than doubled compared with September 2021 because of the impact the war in Ukraine has had on global demand for Canadian potash.

Construction expands

The construction sector expanded 0.5% in September, largely driven by a gain in engineering construction activity (+1.7%). There were also increases in non-residential building and repair construction. Residential building construction was the only exception as it recorded a 0.6% decline, continuing the downward trend that began in April. Despite declines in five of the last six months, residential building construction was more than 6% above its February 2020 level, before the COVID-19 pandemic, but about 16% below its April 2021 peak.

Agriculture continues to grow, led by crop production

The agriculture, forestry, fishing and hunting sector rose 0.8% in September, led by an increase in crop production. Crop production (except cannabis) expanded 0.7%, recording the 12th consecutive monthly increase following drought conditions in Western Canada in 2021. Increased production was largely driven by better growing conditions, leading to higher-than-expected yields.

Manufacturing activity continues to weaken

The manufacturing sector decreased 0.1% in September. This was its fourth decline in five months, bringing the sector’s activity level back to its lowest since January 2022. A decline in non-durable goods manufacturing was partially offset by increased activity in durable goods manufacturing.

Non-durable goods manufacturing fell 0.9% in September, as seven of the nine subsectors declined. Food product manufacturing (-1.4%) contributed the most to the decrease, as lower levels of meat and seafood product manufacturing offset growth in fruit and vegetable preserving and specialty food manufacturing as well as grain and oilseed milling.

Durable goods manufacturing rose 0.6% in September, despite 6 of the 10 subsectors decreasing. This was a rebound from two consecutive monthly declines; however, the activity level remained below the 2022 peak recorded in June. Machinery manufacturing drove growth, led by gains in agricultural, construction, and mining machinery manufacturing and industrial machinery manufacturing.

Transportation equipment manufacturing declined, as production remained constrained by limited semi-conductor availability, tempering the increase in durable goods manufacturing.

Declines or slow growth in client facing industries halts growth in services-producing industries

Services-producing industries were essentially unchanged in September despite a contraction in the majority of sectors, including a reduction in retail trade and wholesale trade activity. However, increases in the health care and social assistance and the professional, scientific and technical services sectors largely offset the declines.

Retail activity edges down

The retail trade sector edged down 0.1% in September, as 6 of the 12 subsectors decreased.

Food and beverage stores declined 1.9% in September to reach its lowest level since April 2018. Broad-based declines were observed across all four store types in the subsector, with the supermarkets and other grocery (except convenience) stores declining the most. In September, prices for food purchased from stores (+11.4%) grew at the fastest pace year-over-year since August 1981 (+11.9%). While food and beverage stores have been trending downward since the beginning of 2021, food and beverage product sales have continued increasing at other store types, such as general merchandise stores.

The overall decline in retail trade was partially offset by activity at gasoline stations, up 4.2%, the second consecutive monthly increase following three months of declines. Gasoline prices fell 7.4% on an unadjusted basis in September, partially due to increased global crude oil supply.

Wholesale trade down after strong increase in August

Wholesale trade edged down 0.1% in September, the third decline in four months, as four of nine subsectors decreased.

Gains and losses were relatively evenly distributed among the major subsectors. Decreases were recorded in the miscellaneous (-3.6%), building material and supplies (-3.0%) and machinery equipment and supplies (-1.0%) merchant wholesalers.

In contrast, the increase in the wholesaling of personal and household goods (+2.8%) partially offset these declines largely due to increased Canadian imports of pharmaceutical products, which rose as the latest COVID-19 vaccine became available. The food, beverage and tobacco (+1.6%) and motor vehicle and motor vehicle parts and accessories (+2.2%) subsectors also contributed to tempering the decline in the sector.

Overall activity in the public sector is essentially unchanged

The public sector (educational services, health care and social assistance, and public administration combined) was essentially unchanged in September following four consecutive monthly gains. The increase in health care and social assistance was offset by declines in educational services and public administration.

Health care and social assistance increased 0.4%, as all subsectors were up, led by hospitals (+0.6%) and ambulatory health care services (+0.4%).

Public administration (-0.2%) declined, as most subsectors were down. There were declines in the federal government (-1.0%) and provincial and territorial (-0.4%) subsectors, partly due to the holiday that was added in the federal public service and some provincial governments to acknowledge the Queen’s passing. Municipal public administration (+0.8%) increased amidst preparations for municipal elections across the country.

Real gross domestic product expands for a fifth consecutive quarter

Real GDP expanded for a fifth consecutive quarter, increasing 0.7% in the third quarter of 2022. Services-producing industries (+0.6%) increased for the fifth consecutive quarter, while goods-producing industries (+1.0%) increased for the fourth consecutive quarter.

Several sectors experiencing consecutive quarterly growth are among the main drivers of growth in the third quarter of 2022.

Several sectors that drove growth in the second quarter continued to be among the main drivers of growth in the third quarter. Natural resources—more specifically, the agriculture, forestry, fishing and hunting (+8.8%) and mining and quarrying and oil and gas extraction (+2.0%) sectors—were among the main contributors to growth in the quarter. Better growing conditions in Western Canada, such as higher-than-average precipitation and moderate temperatures throughout the year, continued to support high annual crop yield and harvest estimates, resulting in another strong quarter for crop production (except cannabis) (+17.7%).

After a slow start to the year, the mining, quarrying and oil & gas extraction sector expanded for a second consecutive quarter, as all subsectors posted gains. Oil sands extraction led the way in the oil and gas extraction subsector, as increased production of crude bitumen in Alberta boosted the subsector despite maintenance activity within the third quarter. The gain in non-metallic mineral mining and quarrying was driven in part by increased potash mining, which expanded for the third consecutive quarter, as exports of the commodity have grown strongly following Russia’s invasion of Ukraine.

The public sector (educational services, health care and social assistance, and public administration combined) continued to be a large contributor to growth in the third quarter, expanding 1.1%. Growth in both federal and municipal public administration as well as in elementary and secondary schools and ambulatory health care services drove the increase.

In the third quarter, professional, scientific and technical services (+1.7%) continued to expand, up for a fifth consecutive quarter. The computer systems design and related services industry, which accounts for the largest share of the sector and was a significant driver of growth in the sector even before the pandemic, drove the gain in the quarter.

Growth slows in some sectors in the third quarter after driving growth in the previous quarter

Client-facing industries, which rebounded from the impact of Omicron variant in the second quarter, expanded at a slower rate and were no longer among the top contributors to growth in the third quarter.

Various factors contributed to this slowdown, including capacity constraints related to labour shortages and the diminishing impact of pent-up demand from the removal of COVID-19 restrictions earlier in the year.

After expanding 5.5% in the second quarter, transportation and warehousing grew 0.3% in the third quarter. Air transportation was among the largest drivers of growth but grew at a slower pace compared with the second quarter, as many airlines and airports faced labour shortages, leading to an influx of flight cancellations. Food services and drinking places increased 1.4% after growing 11.1% in the second quarter.

Interest rate hikes continued to impact activity in the real estate and rental and leasing (-0.0%) and finance and insurance sectors (-0.2%). Activity at the offices of real estate agents and brokers declined for a third consecutive quarter and for the fifth time in the last six quarters as home sales continued to drop, particularly in Ontario, British Columbia and Alberta. Declines in chequing and notice deposits as well as declines in equity and fixed-income mutual fund asset values drove the decline in the finance and insurance sector.

The construction sector increased 0.7% in the quarter despite continued weaker activity in the residential and non-residential building as well as repair construction subsectors. Engineering and other construction activities contributed the most to the gain, supported by ongoing construction of the LNG terminal in British Columbia and by wind farm projects in Alberta.

Weaker residential building construction in both the United States and Canada impacted other sectors of the economy, such as manufacturing and wholesale trade. Decreased activity in fabricated metal product manufacturing, such as architectural and structural metals, and in wood product manufacturing largely contributed to the decline in durable goods manufacturing in the quarter. Building material and supplies wholesalers posted a second consecutive decline in the third quarter and contributed to temper growth in the overall wholesale trade sector.

Retail trade also slowed growth in the quarter, in part due to decreased activity at gasoline stations as households faced higher fuel prices.