Tackling Excess Stock: A Supply Chain Call to Action

March 14, 2024

By Caroline Croft, Supply Chain Consultant, Croft & Associates Supply Chain Consulting

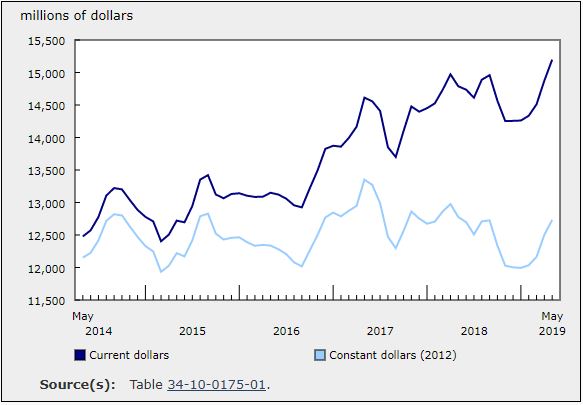

Wow, what a difference a year makes! Empty shelves in 2022 became excessively overstocked in 2023. While it may be easy to lay the blame with Covid-19, let’s not forget distribution inventories and manufacturing lead times within our industry have always flexed up/down through economic cycles, even during in-year build seasons. Instead of laying blame let’s recognize how Covid amplified existing supply chain challenges, both in speed and extremity, over the past four years.

In 2020, the pandemic triggered panic buying across a locked-down general public. In contrast our industry seemed to demonstrate outstanding resilience and agility, adapting to supply disruptions, managing risks caused by localized shut-downs around the globe. However, by the end of 2020 manufacturers faced challenges resetting lead times before the start of 2021 build season, per the usual annual cycle. Chaos ensued when lead times jumped from 6 weeks to 6 months over-night, prompting advance purchases well into the future.

Throughout 2022, those with available stock gained significant sales advantages. Despite early signs of lead time recovery at the end of 2022, advance purchasing continued in 2023 as demand dropped off, some regulatory news from CRTC didn’t help the telecom sector. Inventories quickly built up and layoffs occurred through out the supply chain – manufacturing, wholesale distribution and large-scale end users. In summary, the industry experienced resilience in 2020, chaos in 2021, record sales in 2022, and a substantial downturn in 2023, swiftly showcasing the volatile nature of supply chain dynamics in our industry and leaving shelves over-flowing with excess stock.

As 2024 begins, wholesale distributors across the industry must confront their predicament and take action to fund the conversion of material into cash. Different types of surplus stock require different solutions. Where obsolete implies material is no longer used in established markets, slow-moving implies there is still a market but demand is dwindling, and over-ordered implies an internal planning error occurred, either reading the market or making a purchase, or combination of both. If standard practice has been followed to incrementally spread the write down of surplus stock over time, obsolete and some slow-moving items should already have a book value of zero or near zero.

A good strategy begins with divesting these written down materials first. Consider engaging companies like TrustClarity that leverage AI to convert excess inventory into searchable listings linked with global buyers external to traditional North American markets. Sujee Jaganathan, Founder & CEO, says “We match surplus (stock) with international buyers, transforming potential waste into gains.” Those gains will provide in year funding to help offset the bitter pill of low margin sales of over-purchased items still sitting on the books at full landed cost value.

For those frustrated with the extreme swings of not enough to too much stock, over and over again, further action is required. Understanding the root cause involves examining distribution’s purchasing practices, supplier delivery performance management, and supply chain visibility. Do your purchase orders lack a defined requested delivery date, implying the supplier can ship ASAP? This practice disempowers distributors to control timing of inbound deliveries.

The idea of standard lead time versus confirmed delivery date on a specific purchase order is widely misunderstood in the distribution sector. Given manufacturers are keenly aware how important standardized lead times are for running their own production lines, there is tremendous potential for distributors to simply ask for the same: stable and predictable lead times. Drive meaningful conversations with suppliers, supported by data and metrics, and seize greater control of inbound deliveries.

Another misconception widely believed is that longer lead times require more stock on-hand, which is untrue. Long lead times necessitate more inventory on-order, with adequate tools and resources to gauge how future delivery dates are tracking against latest demand. More open purchase orders provide more options to pull forward or push out deliveries as required.

In closing, addressing excessive stock entails evaluating purchasing practices and system support. Consider engaging a reputable consulting firm with industry knowledge to assess your capabilities and recommend better practices. Investments in systems and professional development will definitely minimize the effect of the next inevitable swing in our industry’s cycle.

Caroline Croft, founder of Croft & Associates Supply Chain Consulting is a seasoned supply chain executive with 30+ years experience across diverse industries including manufacturing heavy-duty transport trucks, consumer packaged goods, and ballistic body armour, before joining the telecom & electrical industries. She is renowned for simplifying out-sourced supply chains, consistently delivering innovative solutions, and fostering effective collaboration with a strong market oriented focus. She can be reached at www.croftsupplychain.com.